At The Harmoning Agency, we believe understanding your insurance coverage shouldn’t feel overwhelming. When industry changes make headlines, we’re here to help you make sense of what’s happening—without the noise or fear.

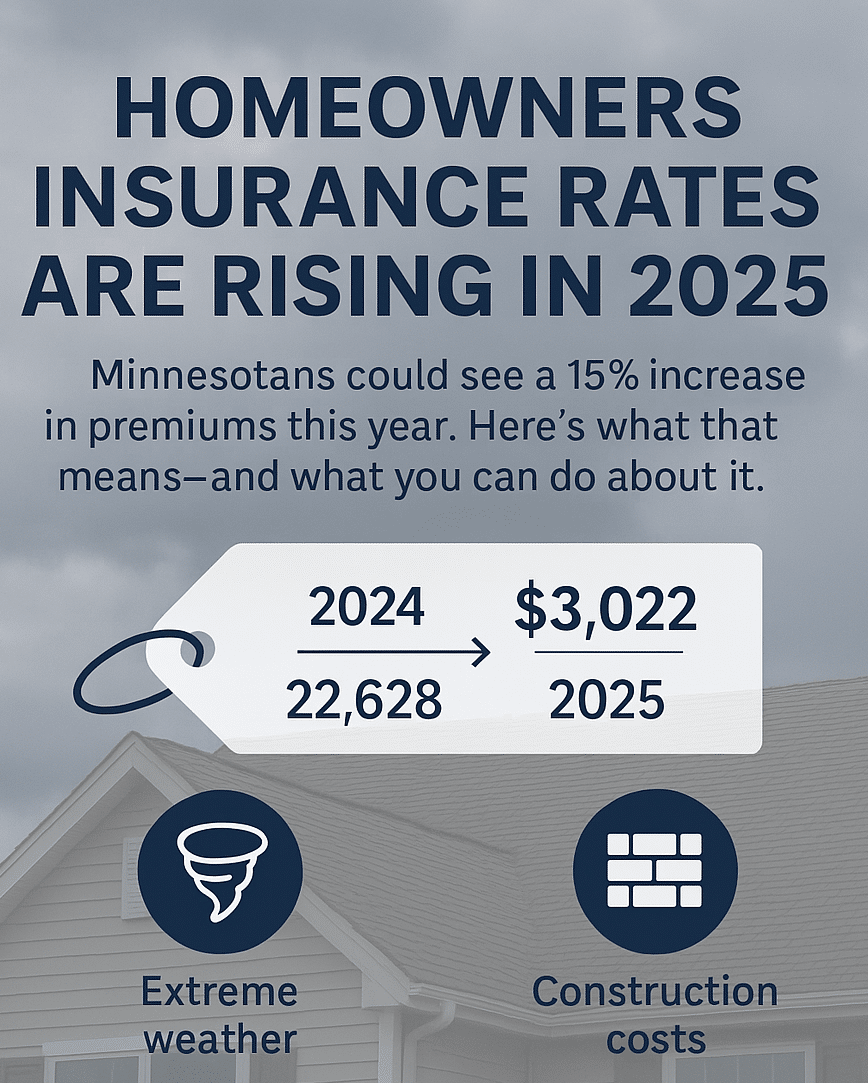

One of those changes? Homeowners insurance rates are rising again in 2025. According to a recent estimate, Minnesotans could see an average 15% increase in premiums this year. Let’s talk about what that really means and what you can do about it.

How Much Are Minnesotans Paying?

According to Bankrate, the average Minnesota homeowner paid $2,628 in 2024 for a policy with $300,000 in dwelling coverage.

If we apply the projected 15% increase for 2025, that means the average premium could rise by roughly $394, bringing the total closer to $3,022 per year.

While that’s a noticeable jump, it’s part of a larger trend that reflects changes happening across the country—and in our own backyard.

What’s Driving the Increase?

1. Extreme Weather Events

Minnesota is no stranger to storms, but the frequency and severity of major weather events have increased. According to the Minnesota Commerce Department, we've experienced 18 billion-dollar weather events in just the last three years. These include damaging hailstorms and heavy winds—events that often lead to widespread insurance claims.

As claims increase, so does the pressure on insurance companies to adjust premiums to reflect current risk levels.

2. Construction Costs Are Still Climbing

Building a home—or even making repairs—is more expensive than it used to be. Labor shortages, supply chain issues, and higher prices on materials have all contributed to a 30% rise in construction costs since 2020. Since insurance is there to help you rebuild after a loss, these rising costs naturally affect the cost of your coverage.

A Strong and Competitive Market in Minnesota

There’s good news too: Minnesota remains one of the most competitive states for homeowners insurance. More than 100 providers are active in the state, which means you have options. Every company assesses risk a little differently, and that gives you the power to shop around for the right coverage at the right price.

How The Harmoning Agency Can Help

At The Harmoning Agency, we take pride in offering personalized, community-focused service. We’re not just agents—we’re your neighbors. We specialize in matching your unique needs with the right coverage from a variety of trusted insurance partners.

Here’s what we recommend:

- Let’s review your current policy together. We’ll help you understand what you’re paying for and if any adjustments can help.

- Explore potential discounts. From security systems to claim-free bonuses, there may be ways to save.

- Take advantage of our independence. We work with several companies, not just one, so we can shop for the best fit on your behalf.

Your Peace of Mind Is Our Priority

Homeowners insurance is more than a policy—it’s a promise. A promise that when the unexpected happens, you’ll have someone on your side to help protect what matters most.

Whether you’re in Franklin, on a farm, or anywhere else in Minnesota, you deserve honest answers and dependable service. That’s what we’re here for.

– The Harmoning Agency Team

Protecting Minnesota’s rural communities with heart and integrity since 2000.